info@smartbizpacific.com

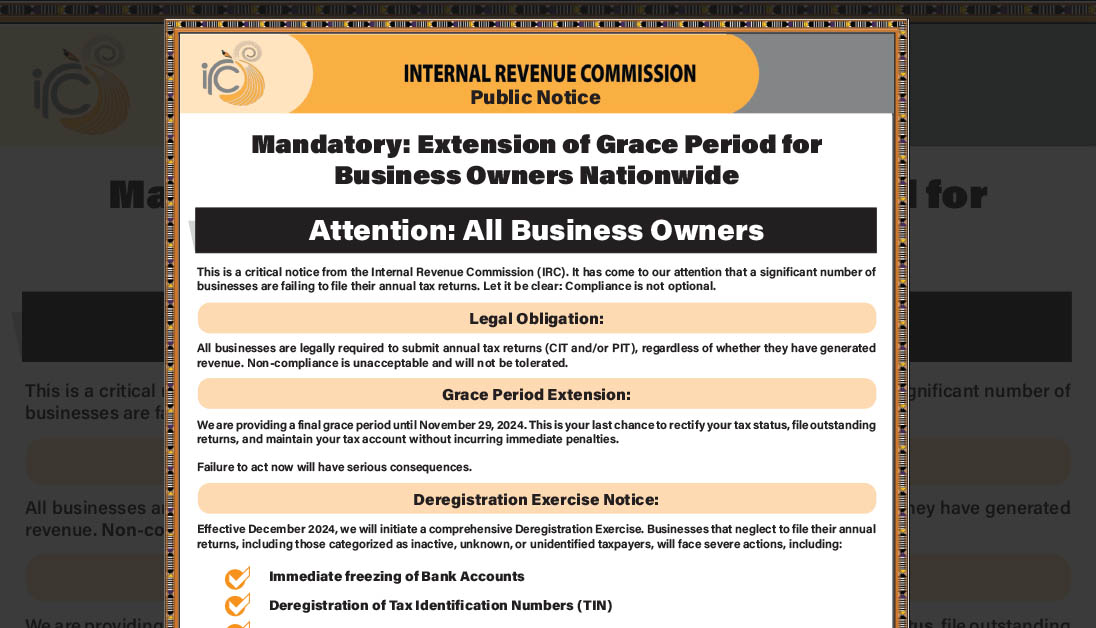

The Internal Revenue Commission (IRC) is issuing a final warning to businesses in Papua New Guinea, reminding them of their obligation to file outstanding tax returns by November 29, 2024. This is the last grace period extended by the IRC, and businesses that fail to comply will face severe penalties, including deregistration, freezing of bank accounts, and suspension of business operations.

For small and medium enterprises (SMEs), ensuring tax compliance is not just about avoiding penalties—it’s about safeguarding the future of your business. With the deadline fast approaching, now is the time to act and secure your business’s financial standing.

Why Tax Compliance is Essential for SMEs

Maintaining compliance with tax regulations is vital for any business, but it’s especially critical for SMEs. Ensuring tax returns are filed on time can:

- Protect Business Operations – Failure to comply can lead to severe consequences, such as the freezing of business bank accounts, which can halt your operations.

- Build Trust and Credibility – Proper tax compliance enhances your reputation with financial institutions, clients, and partners.

- Prevent Unnecessary Penalties – Late or incomplete filings can result in hefty fines, straining your cash flow.

- Prepare for Future Growth – Tax compliance is essential for securing business loans and investments, helping you expand sustainably.

Despite its importance, many SMEs struggle with the complexities of tax compliance. This is where SmartBiz Pacific steps in to assist.

How SmartBiz Pacific Can Help Your SME

At SmartBiz Pacific, we specialize in supporting SMEs with their tax compliance needs. We understand the pressure businesses face and are here to make the process as seamless as possible. Our services include:

- Tax Return Preparation – We help ensure that your tax returns are accurate and filed on time, in full compliance with IRC regulations.

- Tax Advisory Services – Whether you’re new to business or an established SME, we offer expert guidance on navigating tax laws.

- Audit Support – Should your business be subject to an audit, we’ll guide you through every step to minimize risks.

- E-lodgment Assistance – We streamline the filing process through digital submissions, saving you time and ensuring accuracy.

Why Choose SmartBiz Pacific?

- Expert Knowledge – Our team stays up-to-date with the latest tax regulations to provide you with reliable advice.

- Efficiency – We save you time by managing the complex tax filing process, allowing you to focus on your business.

- Cost-Effective Solutions – We offer affordable services tailored to SMEs, helping you avoid the financial burden of penalties.

Act Now to Avoid Penalties!

With the IRC’s final grace period fast approaching, SMEs need to ensure their tax returns are in order. Don’t risk penalties or business disruptions. Let SmartBiz Pacific handle your tax compliance challenges so you can concentrate on what matters most growing your business.

Contact us today for a free consultation to discuss your tax compliance needs. We’ll help you meet the November deadline and secure your business’s future.

Reach out to SmartBiz Pacific at info@smartbizpacific.com to schedule your free consultation. Time is running out—make sure your SME is fully compliant and prepared for success!