info@smartbizpacific.com

Taxation

With the Government’s intention to collect revenue from the Internal Revenue Commission (IRC), the Tax office has put a significant pressure on the companies and individuals to comply with tax laws.

We have exceptional expertise in this area, we offer strategic consultancy from the establishment of new entities to resolving tax conflicts with the tax authorities. We advise clients on how to achieve their business objectives by reducing their tax risks and meeting their compliance obligations.

Taxation in Papua New Guinea

- Preparation of income tax returns, SWT, GST and other tax returns

- Other tax matters – TIN certificate, GST refund, de-registration, stamp duty, COC, GST exemption, TIN certificate, tax clearance certificate

- Complicated tax issues with the Internal Revenue Commission (IRC)

Value-add

- Timely lodgement of tax returns

- Attend to complicated tax issues in solving error on the IRC SIGTAS system

Payroll Services

- Payroll tax calculation (SWT – Citizen and Non- citizen)

- Posting of payroll transactions

Fortnightly payroll runs for employees through Kundu Pei

Value-add

- Simplify payroll processing

- Alignment to regulations

- Insights derived on tax compliance

Consultancy Services

IPA/ROC

Local company registration

- Business name registration

- Incorporation of association

- Foreign enterprise registration and certification

- Preparation of annual returns

- Renewal of business names

- Bi – annual reports

- Change of directors

- Change of company details

- Reinstatement and deregistration of company

Taxation Services

- TIN certificate (TIN 1 & 2)

- New or renewal of certificate of compliance (COC)

- Monthly tax returns for GST, SWT & other tax returns

- IRC error corrections with complicated tax issues

- Stamp duty for new or investment properties

- Tax clearance certificate (TCC)

- Tax exemption for clubs, NGOs, associations and sporting bodies

- GST refund for credits available or over payment of taxes

Other Services

- Business Email set up

- Business Website design and hosting

- Company or business profile

- Association profile

- Proposal writing

- Assist with opening of bank account

- Assist with acquiring of bank loan

- NID and passport services

- Trust account management services

Our Clients

As the November 30, 2023, deadline fast approaches, businesses in Papua New Guinea must be aware of the critical requirement set forth by the Investment Promotion Authority (IPA). This date marks the final opportunity for companies to complete their reregistration process. Failure to comply with this directive will have significant consequences, leading to the de-registration […]

Small business owners and sole traders in Papua New Guinea are reminded that the Small Business Tax (SBT) for Q3 is due on 28 October. The SBT is a simplified tax system by the Internal Revenue Commission (IRC) designed to make tax reporting easier for micro and small enterprises earning up to K250,000 per year. With rates as low as K250 annually, it’s one of the easiest ways to stay compliant and build your financial credibility.

At SmartBiz Pacific, we help SMEs, startups, and sole traders manage their tax registrations, bookkeeping, and returns — so you can focus on running your business while we handle your tax and compliance challenges.

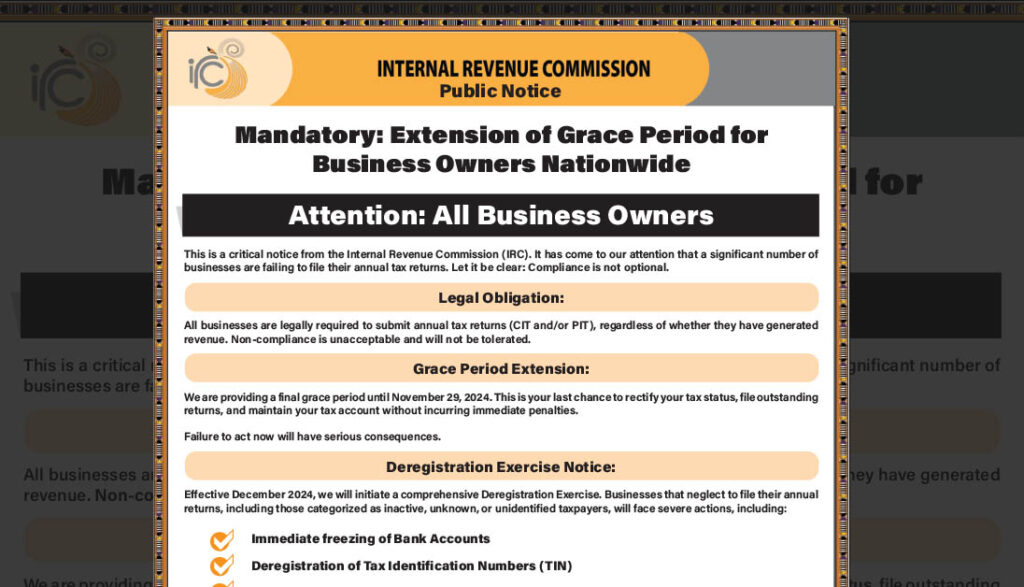

The Internal Revenue Commission (IRC) is issuing a final warning to businesses in Papua New Guinea, reminding them of their obligation to file outstanding tax returns by November 29, 2024. This is the last grace period extended by the IRC, and businesses that fail to comply will face severe penalties, including deregistration, freezing of bank […]

The Internal Revenue Commission (IRC) has recently announced the de-registration of inactive Taxpayer Identification Numbers (TINs), causing widespread concern among individuals and SME owners who have not been compliant with their tax returns. At SmartBiz Pacific, we are here to emphasize the importance of staying on top of your tax obligations and updating your TIN […]